Louisiana Tax Overhaul Advances as Income Tax Cut Proposal Clears Key House Committee

The Public Affairs Research Council of Louisiana (PAR) presented findings indicating the proposal would most benefit lower-income residents. “The largest percentage reductions in income tax occur at the lower income levels,” said Stephen Procopio of PAR.

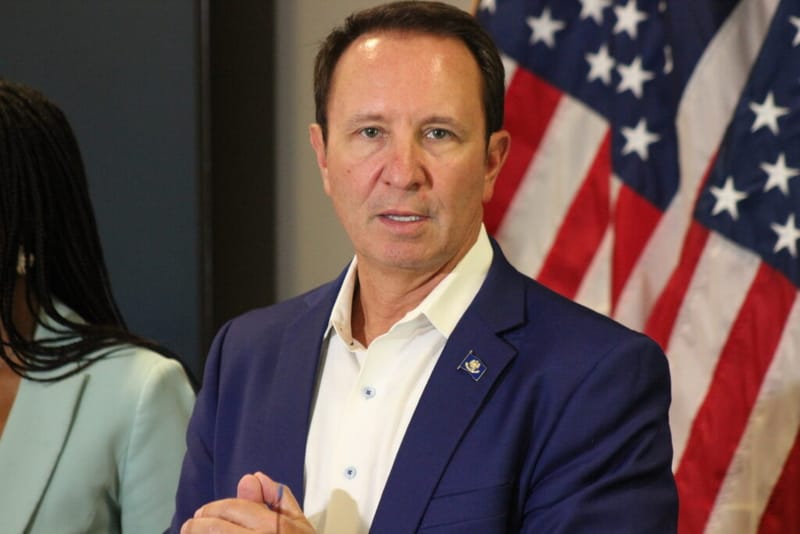

BATON ROUGE, La. — Louisiana’s push for tax reform took a significant step forward as Governor Jeff Landry's proposal to reduce state income tax to a flat 3% passed the House Ways and Means Committee with strong support. Governor Landry has framed the reform as a move toward a more balanced tax structure.

Secretary of the Department of Revenue Richard Nelson, who crafted the plan, highlighted its impact on low-income residents and seniors. “With these changes, 20% of the state will no longer owe income taxes, and about a third of seniors will also be exempt,” Nelson explained.

The Public Affairs Research Council of Louisiana (PAR) presented findings indicating the proposal would most benefit lower-income residents. “The largest percentage reductions in income tax occur at the lower income levels,” said Stephen Procopio of PAR.

To offset revenue losses, the plan introduces new service taxes on activities such as tattooing, pet grooming, and political lobbying—services more commonly used by higher-income residents. “Higher income levels will see the largest increases in sales tax,” Procopio added.

The proposal also suggests scaling back tax credits and exemptions, which lawmakers will discuss in the coming weeks. However, some legislators, including Rep. Mandie Landry, raised concerns about the added tax burden on everyday services. “This means we’re adding new taxes on services people currently don’t pay for,” she said during the committee session.

Jan Moller of Invest in Louisiana warned about the potential risk, emphasizing that Louisiana faces a projected budget shortfall of around $700 million. “Cutting available revenue could impact essential services,” Moller argued, pointing to schools, infrastructure, and community safety as priorities that could be affected.

Nelson acknowledged that the proposed 3% rate depends on the entire plan’s implementation. “If parts are left out, we might need to adjust the rate higher to cover revenue needs,” he said.

The tax reform bill will next be presented for debate in the full House.